WEEKLY MARKET OUTLOOK FOR NOV 06 THRU NOV 10, 2017

In our previous Weekly note, we had mentioned about

possibilities of the benchmark NIFTY50 marking fresh marginal highs while still

not giving any meaningful up move. In line with this analysis, in the Week that

has gone by, the Index continued to mark fresh highs but ended up with net

gains of just 129.45 points or 1.25%. In the coming week, we expect the

benchmark Index to there are enough signals on the Charts that indicate that

any meaningful and serious up move will still continue to elude us. In most

likelihood, with the liquidity chasing the momentum vigorously, we will see

NIFTY marking intermittent marginal highs.

At this juncture, despite very buoyant undercurrents, we

cannot ignore the fact that there are evident bearish divergences on the lead

indicators. On the top of this, as very clearly marked on the Charts, the NIFTY

has resisted to the upper trend line of the 22-month long upward rising channel

that it has been trading in. This is all likely to force and keep the Markets

under consolidation at higher levels.

The levels of 10525 and 10690 will play out as immediate

resistance levels. Supports exist at 10360 and 10220.

The Relative Strength Index – RSI on the Weekly Chart is 70.9877.

It trades moderately overbought. A bearish divergence appears as the NIFTY has

marked a fresh 14-period high while RSI did not. Weekly MACD has reported a

positive crossover and it is now positive trading above its signal line.

Pattern analysis clearly indicates the Index testing the

upper band of the 22-month long trading channel that it has been trading in. In

all likelihood, we see the Markets consolidating at higher levels.

All and all, it is beyond all discussions that the

undercurrent setup remains buoyant. The only reason Markets have to take a

breather is that it has tested the 22-month long trend line and might resist

there. Another reason is the persistent bearish divergences that appear on the

lead indicators. The F&O data indicates that downsides, if any would remain

limited. However, there are all indications that the coming week may remain

volatile in nature and see highly sector specific performances taking place.

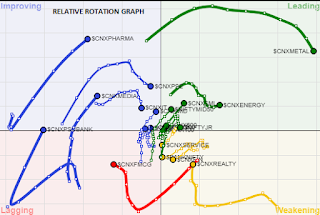

A study of Relative Rotation Graphs – RRG show that significant

improvement is seen in PSUBANK pack mainly due to its move in the previous

week. It is seen that the PHARMA, AUTO, MEDIA and MIDCAP packs are clearly

readying themselves to take on the baton as next relative out-performers over

coming week. REALTY is still seen consolidating while the FMCG pack is likely

to continue to lag and relatively underperform the general markets. INFRA too

is showing distinct signs of strength. METAL is seen slowly continuing to give

up momentum though may consolidate and show limited downsides.

Important Note: RRG™ charts show you the relative strength and momentum for a group of

stocks. In the above Chart, they show relative performance as against NIFTY

Index and should not be used directly as buy or sell signals.

(Milan Vaishnav, CMT, MSTA is

Consultant Technical Analyst at Gemstone Equity Research & Advisory

Services, Vadodara. He can be reached at milan.vaishnav@equityresearch.asia

Milan Vaishnav, CMT, MSTA

Technical Analyst

(Research Analyst, SEBI Reg.

No. INH000003341)

Member:

CMT Association (Formerly Market Technicians Association, (MTA), USA

Canadian Society of Technical Analysts, (CSTA), CANADA

Society of Technical Analysts, STA (UK)

+91-70164-32277 / +91-98250-16331