Global positivity fueled by Federal Reserve’s Chair Janet

Yellen’s comments coupled with favorable macro economic data pushed the buoyant

Markets even higher as the benchmark NIFTY50 scaled yet another fresh high and

ended the day with decent gain of 75.60 points or 0.77%. On Friday, a positive

start yet again is expected. Despite the overbought nature of the Markets which

certainly compels the participants to remain vigilant at these levels, buoyancy

is likely to persist in the Markets going ahead.

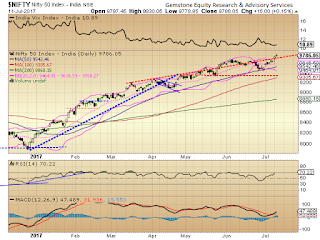

The levels of 9935 and 9960 are likely to act as resistances

ahead as we remain in the uncharted territory, supports will come in at 9820

and 9750 zones.

The Relative Strength Index – RSI on the Daily Chart is 76.2165

and it has marked a fresh 14-week high which is bullish. However, it trades in

overbought territory. The Daily MACD stays bullish while trading above its

signal line. On Candles, a rising window occurred. This is essentially a gap

which indicates buoyant uptrend to persist and continue.

Pattern breakout is seen as the Markets continue to chart in

uncharted territory marking higher tops and higher bottom in a rising channel.

It is approaching the measuring implications of the breakout that occurred from

8900-8950 levels but it still has some distance to travel.

The Markets are overbought and the lead indicators remain in

overbought territory. This certainly warrants caution from the Market

participants but it is much evident from the F&O data and the overall

structure that the buoyancy is likely to persist. We reiterate to avoid shorts

at any levels, remain stock specific and continue to protect profits at higher

levels vigilantly while we chase the momentum.

Milan Vaishnav, CMT

Technical Analyst

(Research Analyst, SEBI Reg. No. INH000003341)

Member:

Market Technicians Association, (MTA), USA

Canadian Society of Technical Analysts, (CSTA), CANADA

+91-98250-16331