WEEKLY MARKET OUTLOOK FOR JANUARY 02 THRU JANUARY 06, 2017

We had expected in our previous Weekly note that the Markets

may remain stable and attempt making of supports in 7900-7920 zones. Keeping in

line with this analysis, the NIFTY ended the last trading day of the year 2016

on a buoyant note and ended the Week with net gains of 200.05 points or 2.51%. In the coming week, we can fairly

expect the 7900-7920 zones at firm support for the Markets. We expect the NIFTY

to consolidate at higher levels. It may reach its logical levels of 8250-8275

levels and consolidate at those levels as they hold multiple pattern resistance

levels. With a positive bias, the Markets will consolidate. Some amount of

volatility will remain and minor intermittent profit taking bouts cannot be

ruled out.

For the coming week, the levels of 8200 and 8260 will hold

as immediate resistance levels. The supports come in at 8110 and 8060 levels.

The RSI—Relative Strength Index on the Weekly Chart is

46.1442 and it remains neutral as it shows no bullish or bearish divergence or

any failure swings. The Weekly MACD is bearish as it trades below its signal

line. However, it has potentially marked its lows and is moving towards

positive crossover in coming weeks. On the Candles, an Engulfing Bullish

Pattern has occurred. Importantly this pattern has occurred after a

downtrend and some consolidation and therefore it marks the present lows at as

potential bottom.

While having a look at pattern analysis, the NIFTY has

nearly 50% of its rally from 6900 to 8900-odd mark and this retracement of 50%

has held as its support for the immediate short term. The NIFTY had marked a

potential bottom around 7916 levels and while the NIFTY took support once again

near these levels, it has potentially confirmed this support. It would be

crucially important now for the NIFTY to maintain this support and confirm the

reversal by forming a higher tops and higher bottoms on the Charts.

All and all, the coming week is likely to remain positive

and though we cannot expect any runaway rise once again, the NIFTY will

continue to mark modest gains with positive bias. The sector rotation is very

much evident since last previous two weeks and select pockets will continue to

support the Markets and out-perform. Positive outlook is advised for the coming

week. The softening of yields and the Rupee is remaining relatively stable and

in capped range with aid this reading in the coming week.

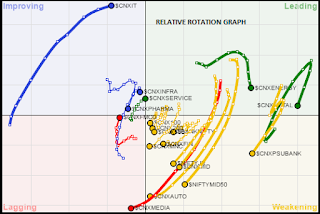

A study of Relative Rotation Graphs – RRG suggest though

ENERGY and METAL stocks will continue to lead the Markets, we will see them

slowly losing momentum and some amount of profit taking can be expected. IT

stocks will continue to outperform and we will see continued and improved performance

from FMCG stocks as well. CNXSERVICE and INFRA stocks are also likely to do

well. MEDIA stocks are expected to lag and considerable loss of momentum can be

expected in PSUBANK, CNXMEDIA, CNXMID and NIFTYJR stocks. However, select stock

specific performance within these indices will be seen.

Important Note: RRG™ charts show you the relative strength and

momentum for a group of stocks. In the above Chart, they show relative

performance as against NIFTY Index and should not be used directly as buy or

sell signals.

(Milan Vaishnav, CMT, is

Consultant Technical Analyst at Gemstone Equity Research & Advisory

Services, Vadodara. He can be reached at milan.vaishnav@equityresearch.asia)

Milan Vaishnav, CMT

Technical Analyst

(Research Analyst, SEBI Reg.

No. INH000003341)

Member:

Market Technicians Association, (MTA), USA

Canadian Society of Technical Analysts, (CSTA), CANADA

+91-98250-16331