MARKET TREND FOR FRIDAY, NOVEMBER 18, 2016

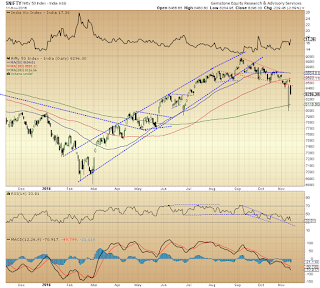

The Indian Equities continued to remain “oversold” and once

again traded much on analyzed lines. We had mentioned that there are chances of

NIFTY continuing to remain oversold and still remain under pressure. The NIFTY

ended yesterday with a modest loss and continued to trade below its 200-DMA as

well. Today, we continue to keep our analysis on similar lines. Though we may

witness a stable opening, the session will remain weighed down by domestic issues

and the levels of 8070 will remain critical point to watch at Close levels.

For today, the levels of 8151 and 8195 will act as immediate

resistance levels while supports will come in at 8070 and 8005 levels.

The RSI—Relative Strength Index on the Daily Chart is

26.7502 it has reached its lowest value in last 14-days which is bearish. It

does not show any bullish or bearish divergence and it remains very much in

“oversold “zone. The Daily MACD stays bearish as it trades below its signal

line. On Candles, a long upper shadow

occurred. It is important to note that this is not a classical long upper

shadow as current upper shadow is little shorter than what is required, it can

leads to potential bottom formation. But once again, it significant diminishes

a bit as it is more effective trend reversal signal when it occurs during an

uptrend which is not the present case.

On the derivative front, the NIFTY November futures have

shed 99,600 or just 0.53% in Open Interest. This figure remains unchanged and

therefore no significant creation of shorts or short covering was observed at

current levels.

Coming to pattern analysis, the NIFTY has given a downward

breakout from a falling channel drawn from 8968 levels. It is now important to

note that post the negative breakout on the downside from the falling channel,

the NIFTY has completed the measuring implications that arise from such

negative breakout. Further to this, it continues to trade a notch below its

200-DMA but still remains within its 1% filter and at the same time remains

heavily oversold.

All and all, given the oversold nature of the Markets and

given the fact that the NIFTY PCR stands below 0.75 chances of a technical

pullback cannot be ruled out even if we continue to remain in a continuing

downtrend. However, as mentioned in the beginning, the session may still remain

weighed down by domestic issues and we might see some volatile selling bouts

but downsides will also remain protected. Overall continuance of a cautious

approach with preservation of cash is advised for today.

Milan Vaishnav, CMT

Technical Analyst

(Research Analyst, SEBI Reg.

No. INH000003341)

Member:

Market Technicians Association, (MTA), USA

Canadian Society of Technical Analysts, (CSTA), CANADA

Association of Technical Market Analysts, (ATMA), INDIA

http://milan-vaishnav.blogspot.com

+91-98250-16331