MARKET TREND FOR FRIDAY, AUGUST 12, 2016

Last hour recovery in the Markets helped it to end the day

with modest gains but it continued to remain in corrective mode. Today as well,

we continue to keep our analysis on similar lines. Today, we can expect the Markets

to once again open on a mild to modestly positive note but overall, it will

continue to remain under consolidation. Though it has attempted to find a minor

bottom yesterday, any runaway up moves still cannot be expected.

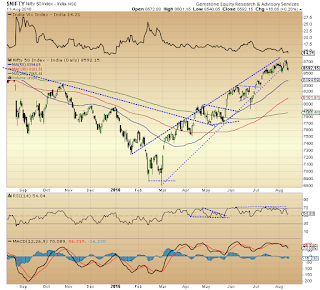

For today, the levels of 8625 and 8675 will continue to act

as immediate resistance levels for the Markets. The supports come in at 8540

and 8505 levels.

The RSI—Relative Strength Index on the Daily Chart is

54.8391 and it remains neutral as it shows no bullish or bearish divergence or

any failure swings. The Daily MACD stays bearish as it trades below its signal

line. On the candles, though it is not at a Classical Hammer, a small

hammer-like formation raises some hope of a potential bottom formation. Though

it need confirmation by any means.

On the derivatives front, the NIFTY August futures have remained

nearly unchanged as it shed 57,300 or just 0.22% in Open Interest. The Open Interest

too remains unchanged.

Coming to pattern analysis, the Markets have fallen out on

the downside from the upward rising channel drawn from the February lows. As

mentioned often in our previous editions, this Channel was getting narrower

with each passing day and a sharp either side movement was expected. This

happened on the downside as the Markets were anyway showing signs of a fatigue.

This has made the levels of 8700-8715 an interim top for the Markets for the

immediate short term. No runaway moves will be expected until the Markets moves

past these levels. However, again as mentioned often in our previous editions, with

the overall inherent structure of the Markets remaining buoyant, these

corrections will be met with relatively limited downsides and some range bound consolidation.

Overall, keeping the above in view, we reiterate our

analysis to use all possible upsides to vigilantly protect profits at higher

levels while continuing to utilize all downsides to make fresh selective

purchases. However, given the fact that volatility will continue to remain

ingrained, major shorts should be avoided and higher proportion of liquidity

should be maintained while adopting a cautious outlook on the Markets given the

long weekend next week as Monday will remain a trading holiday on account of

Independence Day.

Milan Vaishnav, CMT

Technical Analyst

Member: Market Technicians Association, (MTA), USA

Member: Association of Technical Market Analysts, (ATMA), INDIA

+91-98250-16331