MARKET REPORT November

05, 2014

The Markets remained closed on Thursday, November 6th

. On November 5th, the session remained more or less on expected

lines wherein the Markets consolidated and ended the day with minor gains. The

Markets saw positive opening it remained in positive territory throughout the

session. The Markets saw a relatively quiet opening and soon traded positive

with minor gains. The Markets, while maintaining these modest gains, spent most

part of the session in a very narrow 25-odd points range. In the afternoon

trade, the Markets saw some pressure coming in as it pared all of its gains to

trade flat. However, the late afternoon trade saw minor spike which took the

Markets to its intraday high of 8365.55. It came off a bit again but finally

managed to end the day at 8338.30, posting a minor gain of 14.15 points or

0.17% while forming a mildly higher top and higher bottom on the Daily Bar

Charts.

MARKET TREND FOR FRIDAY, NOVEMBER 07, 2014

Markets shall once again open while adjusting itself with

global activities and there are chances that we may see a quiet opening once

again. There are also chances that the Markets continue to consolidate while

exposing itself to some pressure from higher levels. Therefore, the analysis

would remain more or less on similar lines that of last two trading sessions.

The levels of 8365 and 8390 would act as resistance and the

levels of 8270 and 8215 would act as immediate supports.

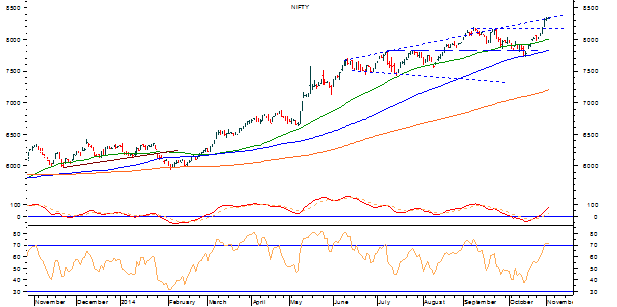

The RSI—Relative Strength Index on the Daily Chart is

71.6069 and it has formed a fresh 14-period high which is bullish. However, it

certainly remains in ‘overbought’ territory and also does not show any bullish

or bearish divergences. The Daily MACD remains bullish while trading above its

signal line.

On the derivative front, the NIFTY November futures have

added yet another 12.76 lakh shares or 5.96% in Open Interest. This certainly

exhibits bullish bias of the Markets and may prevent any correction from higher

levels and reduce it to mere sideways consolidation.

Taking a look at pattern analysis, the Markets continue to

test the upper rising trend line of the broadening formation that is seen on

both Daily and Monthly Charts. As mentioned in our previous editions, such

formations are least useful in achieving breakouts due to its nature and thus

an area pattern is required after which the Markets usually takes a further

directional call.

Overall, given the overall structure of the Markets, the

Markets would still not witness any runaway rise due to the pattern structure

and also due to the fact that it remains overbought. However, instead of a

correction from higher levels, it can end up just consolidating in a ranged

manner. Volatility may persist and there are bright chances that the defensives

may outperform during this time. Therefore, while continuing stock specific

approach, positive outlook is advised for the day.

Milan Vaishnav,

Consulting Technical Analyst,

Af. Member: Market Technicians Association (MTA), USA

Af. Member: Association of Technical Market Analysts, INDIA

www.MyMoneyPlant.co.in

Af. Member: Market Technicians Association (MTA), USA

Af. Member: Association of Technical Market Analysts, INDIA

www.MyMoneyPlant.co.in

+91-98250-16331