MARKET REPORT September

11, 2014

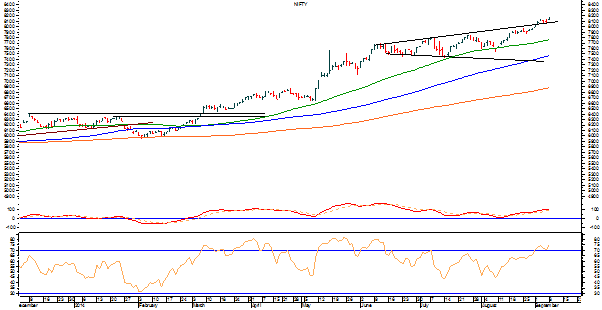

The Markets continued to consolidate in a volatile session

as it chose not to confirm the breakout as yet and ended the day with nominal

losses. The Markets opened on a better than expected positive note and soon

formed its intraday high of 8127.95 in the early minutes of the trade. It

continued trading with capped gains for some time but soon saw a sudden and bit

violent paring of gains. It drifted in the red to form the day’s low of

8057.30. The Markets spent most part of the second half of the session in

trying to recover from the day’s low which it did somewhat successfully to

trade back into the green. However, it pared that recovery as well towards the

end and finally ended the day at 8085.70, posting a nominal loss of 8.40 points

or 0.10% while forming a slightly lower top and lower bottom on the Daily High

Low Charts.

MARKET TREND FOR FRIDAY, SEPTEMBER 12, 2014

Tomorrow’s analysis would remain more or less on similar

lines. The Markets have chose to consolidate and therefore the opening levels

would be critical to decide the trend for the day. The Markets are expected to

open on a flat to mildly negative note, technically speaking, but it will have

to maintain levels above of 8080-8100 to avoid any further weakness from

creeping in.

The levels of 8110-20 and 8150 would act as immediate

resistance and the levels of 8030 and 7970 would act as supports.

The RSI—Relative Strength Index on the Daily Chart is

64.0595 and it is neutral as it shows no bullish or bearish divergence or any

failure swings. The Daily MACD still remains bullish as it trades above its

signal line but is moving towards reporting a bearish / negative crossover.

On the derivative front, NIFTY September futures have gone

on to shed further 5.60 lakh shares or 3.87% in Open Interest. This further

goes on to prove that the Markets have been seeing clear reduction / unwinding

of open positions at every higher level.

Returning back to patterns, as mentioned in our previous

edition of Daily Market Trend Guide, the Markets have shown a throw back

(returning at the same place from where it broke out) and therefore have not

validated the breakout. Taking this further, if the Markets happen to close

below 8080-8050 levels, it would come back within the topping formation which

would certainly prevent the Markets from having any runaway rise. The Markets

will have to maintain the levels above of 8100 in order to just consolidate and

not getting any weaker.

Overall, keeping this in view, we continue with our advice

of taking very restrictive and very selective exposure. Though stock specific

and sectoral out performance would certainly remain, any rallies should be used

to protect existing profits until the attempted breakout gets confirmed or

validated. Until then, while remaining very selective while making new fresh

purchases, the overall exposure should

be kept curtailed accompanied with cautious approach for the day.

Milan Vaishnav,

Consulting Technical Analyst,

+91-98250-16331