MARKET REPORT February

07, 2014

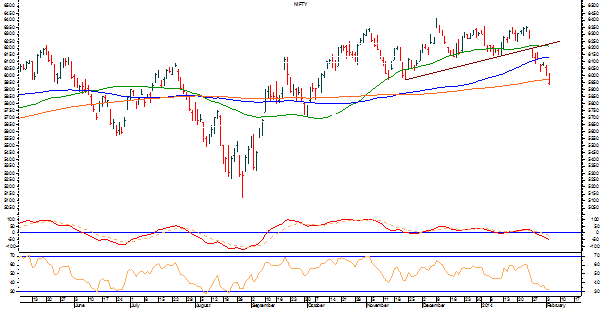

The Markets had an extremely choppy session yesterday as it

saw a very volatile trade on either side which finally resulted in the Markets

ending with nominal gains. The Markets opened on a modestly positive note and formed

its intraday high of 6048.35 in the early morning trade. However, after trading

briefly in a capped range the Markets saw a very sudden and sharp fall. It

dipped very sharply in the negative in a vertical fall and formed its intraday

low of 5965.40. After forming this low in the late morning trade itself, the

Markets formed a rising trajectory thereafter and recovered in the rest of the

session. The Markets gradually recovered

all of its losses in the rest of the session and traded in the green towards

the end. It finally managed to end the day at 6036.30 posting a nominal gain of

13.90 points or 0.23% while forming a higher top and similar bottom on the

Daily Charts.

MARKET TREND FOR TODAY

The Markets have taken support for three times in last three

session and have successfully managed to keep its head above the levels of

200-DMA at Close. Today, expect the Markets to open on a decently positive note and continue with its up move. The

global cues are supportive as the US Markets too have ended in the green after

a pullback post falling below its 200-DMA. The intraday trajectory would

continue remain important.

For today, the levels of 6075 and 6135 would act as immediate

resistance on the Charts. The supports exists at 5977 and 5940 levels.

The RSI—Relative Strength Index on the Daily Chart is 36.67

and it continues to remain neutral without showing any bullish or bearish

divergence or failure swings. The Daily MACD remains bearish as it trades below

its signal line.

On the derivative front, NIFTY February futures have shed

3.41 lakh shares or 2.08% in open interest. This shows some profit taking has

been seen in the rise that we saw yesterday and the pullback may be because of

short covering from lower levels. In either case, this signifies that a bottom

has been attempted at the levels near the 200-DMA.It remains to be seen if we

see fresh long positions getting built up after this. In any case, both FIIs

and DIIs have remained net buyers in both derivative and cash segments

yesterday.

Going by the pattern analysis, the Markets have attempted to

find a bottom and reverse its trend. It is likely to continue with the advance

today with a positive opening and might resist around its 100-DMA levels. It

would consolidate around those levels again and only after that it can be

confirmed that a trend reversal has happened if it moves beyond those critical

resistance levels.

Overall, today, we are set to see a positive opening and the

positive moves shall continue. The intraday trajectory would be important and

the Markets will have to remain in rising trajectory in order to capitalize on

the gains. Select buying can be done while protecting profits at higher levels.

Overall, cautiously positive outlook is advised for today.

Milan Vaishnav,

Consulting Technical Analyst,

+91-98250-16331